The beginning of the end for Public Sector Banks

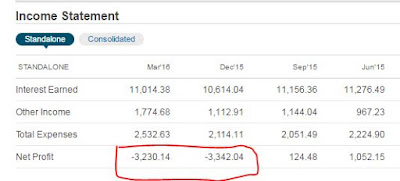

Asset quality of all the public sector banks moved from bad to worse and the quarterly earnings are not looking actually like earnings they are just mere meetings where Money is set aside for NPA's.

Bank of Baroda management expressed that worst is over in terms of NPA's after the Q3 results and see the results of BOB for the Q4.

I read some article in the internet which said that.If you are trying to buy public sector banks say for 150 rupees a share.You are paying 100 rupees for the bank and 50 rs for the Non performing assets.

When you compare public sector banks and private sector banks any day Private sector banks stand out in the performance or any other characteristics.

Some times i feel bad seeing the results of banks our hard earned money which is invested by government into the banks as capital is slowing going through the drain quarter by quarter. Dont know when a public sector bank will declare NPA.See the staggering list of banks that posted Losses in this particular quarter.

- Syndicate Bank loss at 2158 crores. See the profit of this bank in its previous operations so you can understand the amount of problems or dont care attitude of the bank managemets.

See this Bank had a loss which nearly wiped out its say 2 years profit.We never know where the money went or will the money come back,So rather than holding Public sector banks better to hold private sector banks because atleast they will try and make sure they show some profit or else people will move to another private sector banks.

Hope a day comes when all the Public sector banks are closed and there is competition among the private sector banks to provide quality services at reasonable prices.When i go to any public sector bank the attitude of the employees is so frustrating and the attitude of private sector bank employees is so good as they are selling their service to the customers.

Even the Online sites of public sector banks are pathetic and their customer service is also useless and the toll free numbers does not even work out some times.

Some times the SBI toll free number only does not work.It is shown in big size as customer service.

So my only advice to people is dont buy public sector banks go for something like Axis,ICICI,Kotak or yes bank or the best among them HDFC Bank :)